4. Competitive operational costs

The Solomon Islands provides a highly cost-competitive environment for investors, combining some of the region’s most affordable wages with moderate utility rates and a fair, predictable tax system. This balanced structure allows businesses to operate efficiently while enhancing profitability and long-term sustainability.

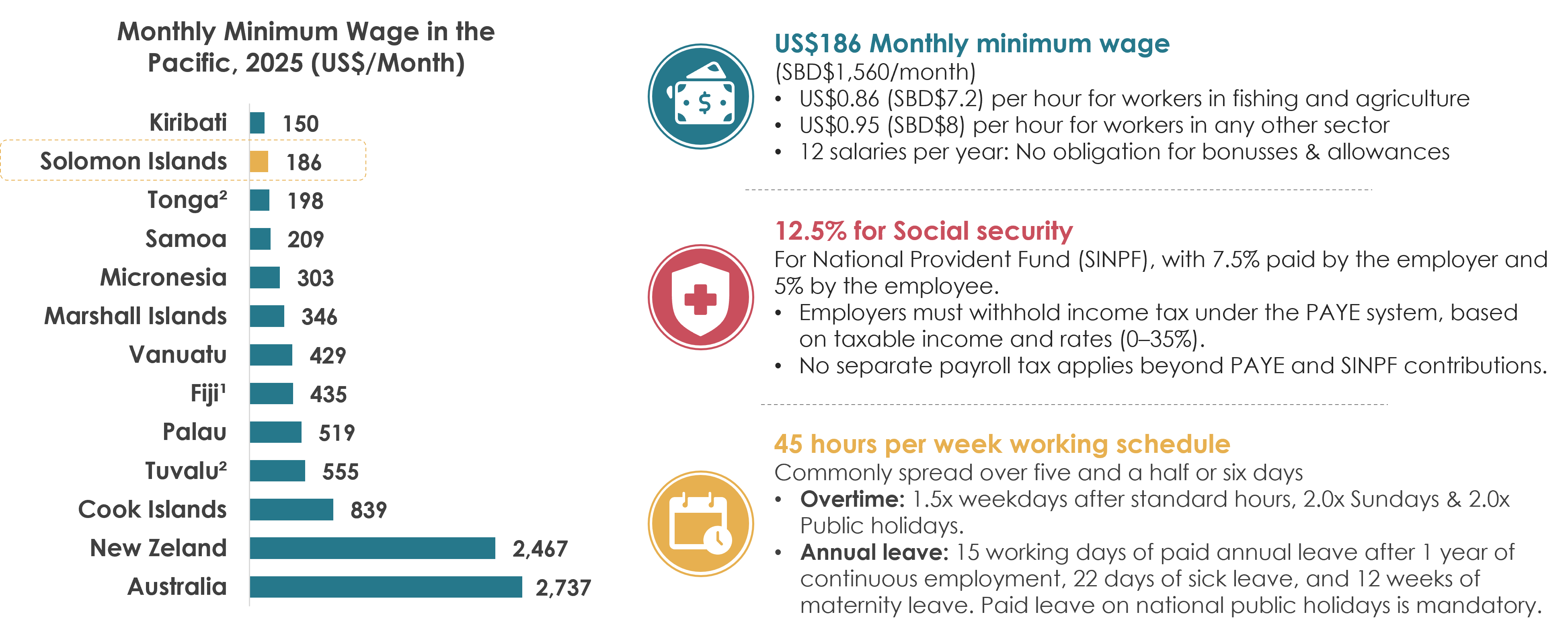

Competitive salaries in the Pacific region

- 2nd most competitive salary among the Pacific States with a monthly average minimum wage of US$186.

- Friendly and business-oriented labor regime, fostering the creation of new employment.

Note1: Average monthly salary corresponds 40 hours per week. Fiji and Solomon Islands are the exception with 45 hours per week. - Note2: Values only for reference. These may change according to exchange rate fluctuations or legislation updates. Salaries do not include mandatory social benefits. - (¹) Minimum wages are set according to province, industry and skill level. - (²) There is no statutory minimum wage. Lowest average salary is used in stead. - Source: https://wageindicator.org/salary/minimum-wage/minimum-wages-per-country - https://www.salaryexplorer.com/#browsesalaries - https://www.rivermate.com/guides - https://www.globalexpansion.com/countrypedia

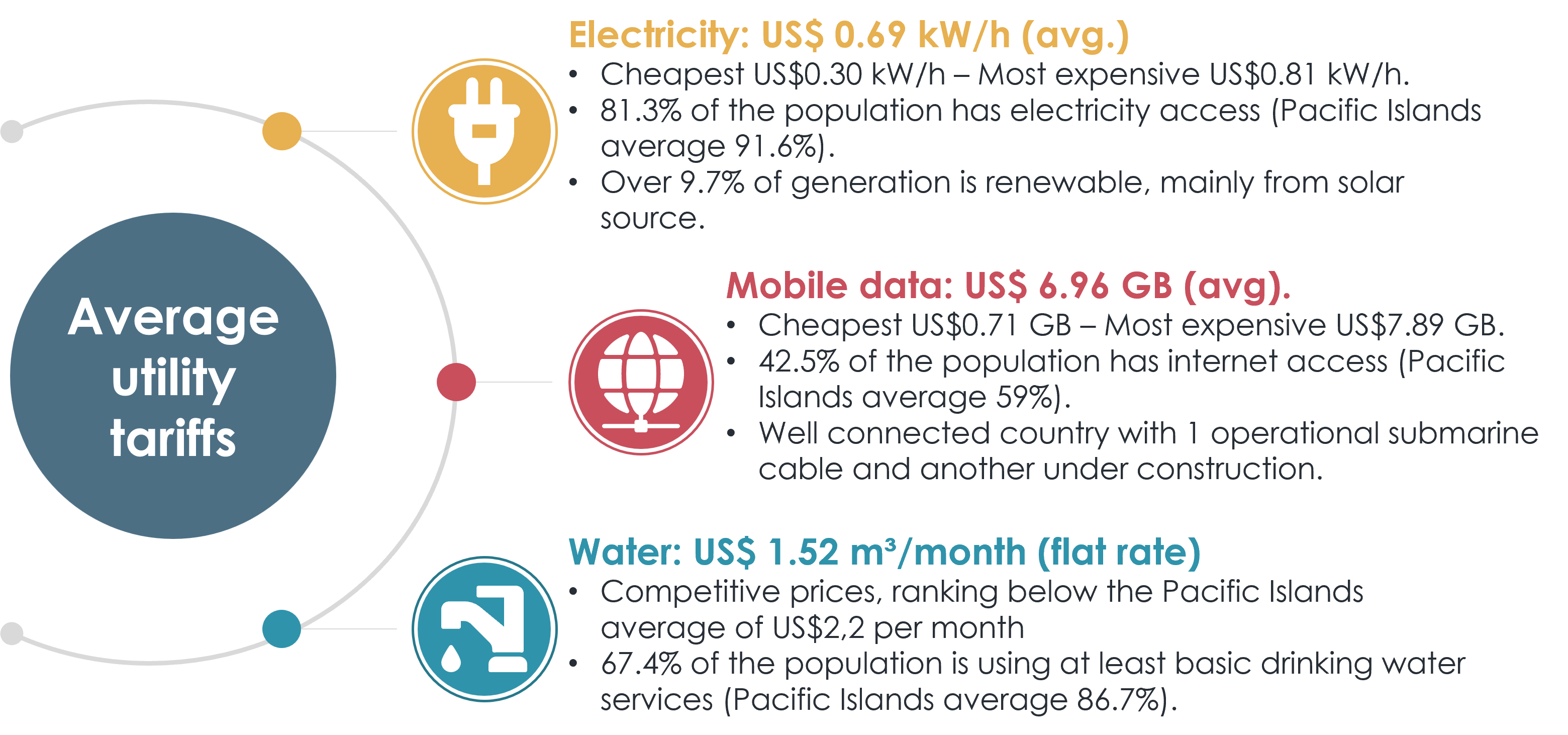

Utility costs overview

The Solomon Islands maintains moderate utility costs compared to many Pacific economies, offering reliable access to electricity, water, and telecommunications at competitive rates. These conditions support business operations while ensuring that investors benefit from predictable and manageable overhead expenses.

Electricity: The Pacific region is the most expensive in the world, averaging US$0.35 kWh, excluding developed economies and overseas territories (values for 2021). Source: https://www.cable.co.uk/energy/worldwide-pricing/ - IRENA renewable capacity statistics 2024 – World Bank Database 2023 - Mobile data: The Pacific is one of the most expensive in the world, averaging US$3.72 per 1GB per 30 days (values 2023). Source: https://www.cable.co.uk/mobiles/worldwide-data-pricing - https://www.submarinecablemap.com/country/solomon-islands - Water: Tariff based on a consumption of 15m3 per month. Average tariffs per country weighted by population served. Source: https://tariffs.ib-net.org/sites/IBNET/VisualSearch/IndexCurrentUSD?RegionId=2&Weight=0&ServiceId=2&Yearid=0&perPage=50

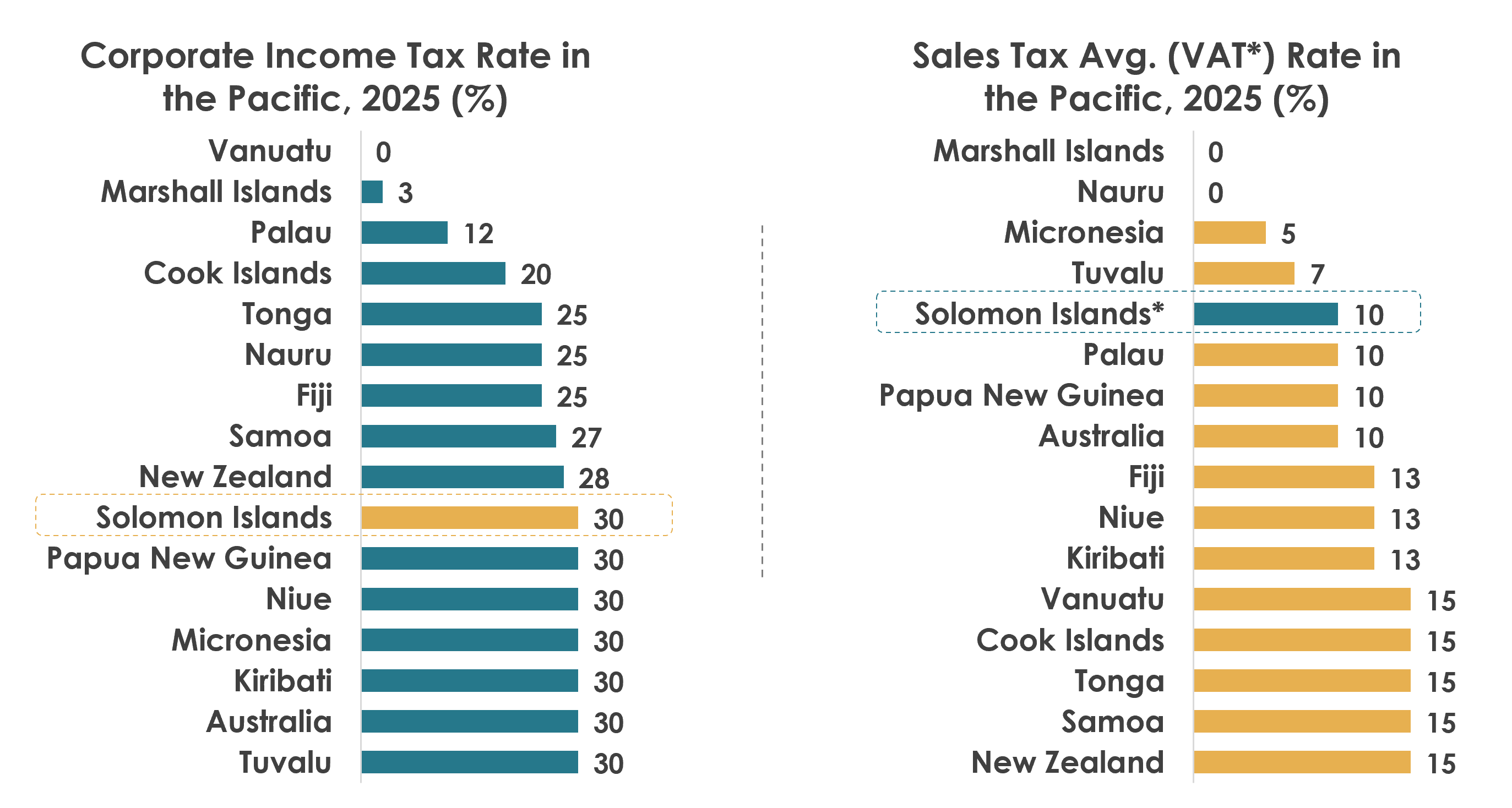

Consistent and reliable tax framework

- Corporate taxation: The Solomon Islands applies a standard corporate tax rate of 30%, aligned with most Pacific Island countries and comparable to Australia, providing investors with a familiar and predictable framework.

- Sales tax* (VAT): The country maintains a competitive VAT rate of 10%, which is below the regional average. This lower rate creates a more favorable tax environment for businesses, reducing operational costs and supporting investment competitiveness.

(*) In Solomon Islands VAT it is called Goods Tax and it is 10% for locally produced goods and 15% for imported. Exempt: Education, medical, and exports. Note1: Income tax by type of activity: Resident company 30%, non-resident company 35%, income from contracting 7.5%, outward income from ships/aircrafts 15%, insurance premium 7.5%, pole & line fishermen 10%, purse seiner fishermen 15%, lease of equipment 15%, and film rental 5%. Note2: Other taxes: Dividend Withholding Tax (30% on dividends to non-residents and 20% on to residents. Dividends are deductible from company income); Services Tax (5% on professional services); Turnover Tax (0.5% of gross income if company reports no profit or loss. Final tax, not offset later. Exempt for companies with tax incentives); Withholding Tax (15% on interest and royalties paid to non-residents). Note3: Rates for other countries are only for reference. They may vary according to company’s sector, revenue, size, new legislation, etc. Source: Tax Foundation - VatCalc - Invest Solomons